Home Loan Resources

Shopping for a mortgage can save you hundreds, even thousands of dollars. Lending Studios will help you identify and pursue the kind of loan that is best for your individual needs.

Buying or refinancing a home requires a careful analysis of your finances and personal goals. Equip yourself before you meet with lenders and secure the best home loan possible.

Lending Studios will empower you with the knowledge you need to make informed decisions.

Mortgage News and Advice

June 12, 2020

Learn more about your mortgage financing options when you start the home-buying process to make sure you get the best loan product for your needs.

June 4, 2020

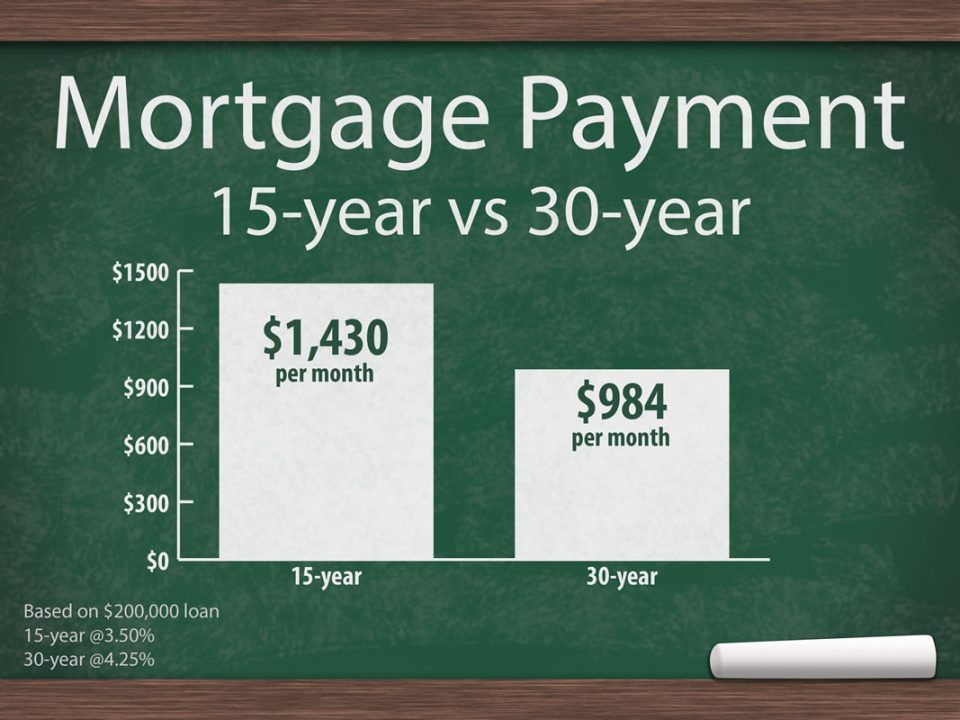

Choosing between a 15-year mortgage or a 30-year mortgage requires a diligent review of the pros and cons of each and how they relate your individual goals/needs.

May 29, 2020

If you are new to home ownership and mortgage shopping, you may not know that mortgage rates change frequently. Lenders across the nation post weekday mortgage rates to a comprehensive national survey so that you know what a competitive rate is.

May 19, 2020

Just because mortgage rates are low, it doesn’t mean it is a wise financial decision to refinance. Knowing when to refinance and when NOT to refinance is a key part of investment strategy.

May 14, 2020

Buying a home requires a careful analysis of your future financial and personal goals so you can enjoy home ownership, not stress over it. Part of […]

May 8, 2020

Shopping for a mortgage rate can save you hundreds, even thousands, of dollars. Mortgage rates can vary in more ways than one depending on the lender. Forbes […]

April 29, 2020

In 2020, you might be considering refinancing your mortgage. Did you know that this year, interest rates are near record-setting lows? The decision to refinance a […]

April 23, 2020

Are you ready for the home buying process? It’s a lengthy one and can be quite a ride, so be prepared to hold on tight. Things […]

April 15, 2020

Are you tired of living paycheck to paycheck? Do you feel like you can’t make a dent in paying down debt? Are you unable to develop […]

April 3, 2020

Learn how refinancing works so you can better assess if this is something you should pursue to help you reach your financial goals.

April 1, 2020

Learn more about the Income-Equity-Credit Mortgage Approval Triangle to prepare for mortgage loan approval. Balancing these three areas is key for success!