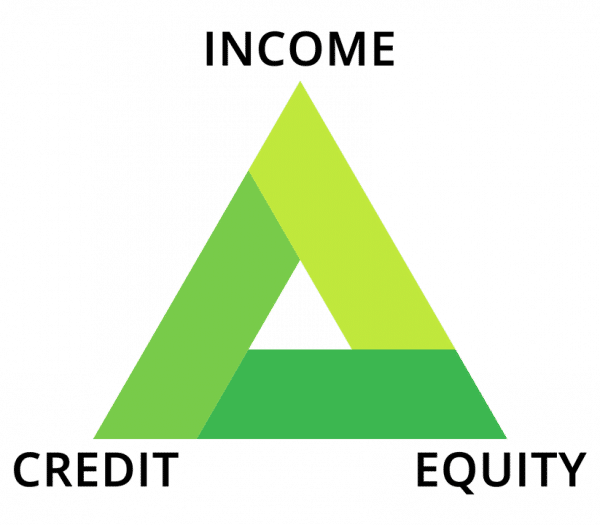

What is the Income-Equity-Credit Mortgage Approval Triangle?

The mortgage industry has gone through considerable changes over the past decade, but one component of the process has remained more or less unchanged and that is the way mortgage loans are underwritten, often referred to as the mortgage approval triangle.

The mortgage industry has gone through considerable changes over the past decade, but one component of the process has remained more or less unchanged and that is the way mortgage loans are underwritten, often referred to as the mortgage approval triangle.

The approval of a loan to a prospective borrower hinges on three primary categories: 1) debt-to-income ratio; 2) loan-to-value; and 3) credit score. Understanding these three aspects of the mortgage approval triangle is key to your loan success. We will discuss each in length below.

Debt-to-Income Ratio

Simply put, the debt-to-income ratio is calculated by dividing a borrower’s monthly household debt by their gross monthly income.

Not sure what we mean? Take this example:

If you pay $1500 a month for your mortgage and another $100 a month for a personal loan and $400 a month for your remaining debts, your monthly debt payments are $2,000. ($1500 + $100 + $400 = $2,000.) Now, let’s say your gross monthly income is $6,000. In this scenario, your debt-to-income ratio is 33 percent. ($2,000 is 33% of $6,000.)

Lenders use the resulting number to assess your ability to manage monthly payments so you can repay what you owe in a timely, responsible manner. It is a “checks and balances” sort of system to help protect lenders from borrowers that may be dangerous investments.

So what is the golden percentage (ratio) that lenders are looking for to lend to you? Not higher than 43 percent.

“Evidence from studies of mortgage loans suggests that borrowers with a higher debt-to-income ratio are more likely to run into trouble making monthly payments. The 43 percent debt-to-income ratio is important because, in most cases, that is the highest ratio a borrower can have and still get a Qualified Mortgage,” the Consumer Financial Protection Bureau (CFPB) states.

Now, with that number is a caveat. Some larger (and smaller) lenders may still choose to approve your loan even if your debt-to-income ratio exceeds 43 percent, but the process is much more complicated and will involve several documentable steps to determine that the borrower has the ability to repay the loan in order for them to still get a Qualified Mortgage.

Loan-to-Value

The next part of the loan approval triangle is what is termed the loan-to-value (LTV) ratio. This ratio is calculated by taking the loan amount and dividing it by the value of the property the borrower wishes to purchase:

LTV ratio= APV/MA

where:

MA=Mortgage Amount

APV=Appraised Property Value

Once this value is established a lender can better understand the owner’s equity stake in the proposed property. The lower the loan-to-value ratio the better, but even higher loan-to-value ratios can still make it through a loan approval process BUT with stipulations.

High LTV ratios pose more investment risk for the lender so the loan will end up costing the borrower more money. Sometimes high LTV ratios will also require that the borrower purchase mortgage insurance to help eliminate some of the risk to the lender.

So what should borrowers shoot for in terms of a good LTV ratio? The majority of lenders will offer lenders low interest rates if the LTV ratio is at or below 80 percent. Some government lending programs like Fanni Mae’s HomeReady or Freddie Mac’s Home Possible will permit LTV ratios of 97 percent but will require mortgage insurance until the ratio falls to 80 percent (and they require 3 percent down of the purchase price.)

If you need to lower your LTV ratio, consider putting more down or try to lower the sales price. Striving to lower your LTV ratio improves your chances of getting your loan approved. This also means a lower interest rate and, perhaps, the ability to forego purchasing private mortgage insurance.

Credit Score

The state of your credit is of utmost importance when it comes to getting loan approval. Here is how it works. Mortgage loan officers will analyze credit scores from the three main credit associations: Experian, Equifax, and TransUnion. The middle of the applicant’s three credit scores will be used for assessing whether or not the loan will be approved.

So, what is the magic number you may ask? What is the minimum credit score needed to qualify for a home loan? While a credit score is just part of the factors considered for loan approval, to qualify borrowers need at least a 500 FICO credit score for a Federal Housing Administration (FHA) loan, and 620 or higher for most other loan products.

According to the U.S. News and World Report, “An FHA loan requires a minimum FICO credit score of either 580 or 500 depending on your down payment. With VA, USDA and conventional loans, no firm minimum score is needed but lenders generally expect a FICO score of at least 620.”

When it comes to preparing for the loan application process, strive for a FICO score between 670-739 if you want to be in a position to get a good interest rate and loan terms for your mortgage loan. But, again, remember, a high credit score doesn’t mean you are a shoo-in for loan qualification.

A strong loan application keeps all three of the areas we have discussed in balance: 1) a debt-to-income ratio below 43 percent; 2) an LTV ratio at or below 80 percent; and a credit score between 670-739.